Consultation available in Japanese | Chinese | English

Incorporate in Japan Gerbera Support

Gerbera Partners' team of specialists in Accounting & Tax, Social Insurance and Labor and Judicial

Scriveners will treat your business with the utmost care where every order is important.

【Tokyo Office】7F Shuwa Sanchome Bldg, 3-23-6 Toranomon, Minato-ku, Tokyo

【Osaka Office】3F Honmachi Heisei Bldg, 1-2-12 Itachibori, Nishi-ku, Osaka

【Fukuoka Office】4F More Grand Bldg, 1-5-8 East Hakata Station, Hakata-ku, Fukuoka

Incorporating in Japan

Incorporation Options

Limited Liability Company (LLC)

Inexpensive to establish.

Its social perception is lower than

that of a joint-stock company.

Certification of articles of

incorporation is not required and

investors have no legally stipulated

term of office. A representative can

call themselves the president or

CEO, but he or she cannot call them

selves the “representative director”.

If the investor (shareholder) is not a

managing partners, there is no need

to change the registration.

Joint-stock Company

It’s possible to raise funds using

stocks. The company can be publicly

listed. Its more socially credible than

an LLC. There is an obligation to

report your financial statements.

(Since there is no penalty, the only

companies that report it are publicly

isted companies and companies

that are going through restructuring)

General Incorporated

Association

A corporation for the purposes of

public interest, unlike an LLC or a

joint-stock company. Dividends

cannot be paid; registration is

required every two years. There is

an obligation to report your financial

statements. Becoming a public

interest incorporated association

provides tax advantages. (but the

are a lot of hurdles to get by)

Comparison of Types of Business Operation

|

| LLC | Joint-stock Company | General Incorporated Association | |

|---|---|---|---|---|

|

| Business objectives | Unrestricted | ||

| Responsibility of | Limited Liability | |||

|

| Body of Law | Corporate Law | General Incorporated Association Law | |

| Purpose | Profit (Pay dividens) | Non-profit (No payment of dividends) | ||

| Organization type | Small scale companies | Small to large scale companies | ||

| Ownership and management seperation | No | Yes | ||

| Reorganization | Possible ( between LLC and Joing-stock Company | Not possible | ||

| Traits | Moderate name recognition and creditiblity | Good credibility | Possibility of becoming a ublic interest incorporated association | |

| LLC | Joint-stock Company | General Incorporated Association | ||

|---|---|---|---|---|

| Profit distribution | Possible (no need to follow the equity percentage) | Possible (allocated according to equity participation ratio) | Not possible⇒Employee compenstaion | |

| Capital | 1 Yen or more | No capital⇒Fund system | ||

| New shareholders | Investment required | No investment required | ||

| Decision-making body for important matters | General meeting of members | General meeting of shareholder | General meeting of members | |

| Second term registration | Unnecessary | Necessary | ||

| Term | No limit | 2 to 10 years (directors) | 2 years | |

| Membership registration | Necessary (managing parterns, representative partners) | Unnecessary | ||

| Obligation to give public notice of accounts | No | Yes | ||

| LLC | Joint-stock Company | General Incorporated Association | ||

|---|---|---|---|---|

| Number of members required | 1 | 3 | ||

| What to prepare | Company seal Deposit of capital Obtaining company seal impression etc. | Company seal Obtaining company seal impression etc. | ||

| Declaration of actual company leader | Unnecessary | Necessary | ||

| Certification of articles of incorporation | Unnecessary | Necessary ( about 50,000 JPY) | ||

| Stamp dity on articles of incorporation | 40,000 JPY (no cost with eletorinic articles of incorporation) | No | ||

| Registration and license tax | 0.7% of capital (minimum 60,000 JPY) | 0.7% of capital (minimum 150,000 JPY) | 60,000 JPY | |

| Gerbera Service | <In Japanese>80,000~100,000 JPY、<In other languages*>150,000~200,000 JPY *English, Chinese, Vietnamese | |||

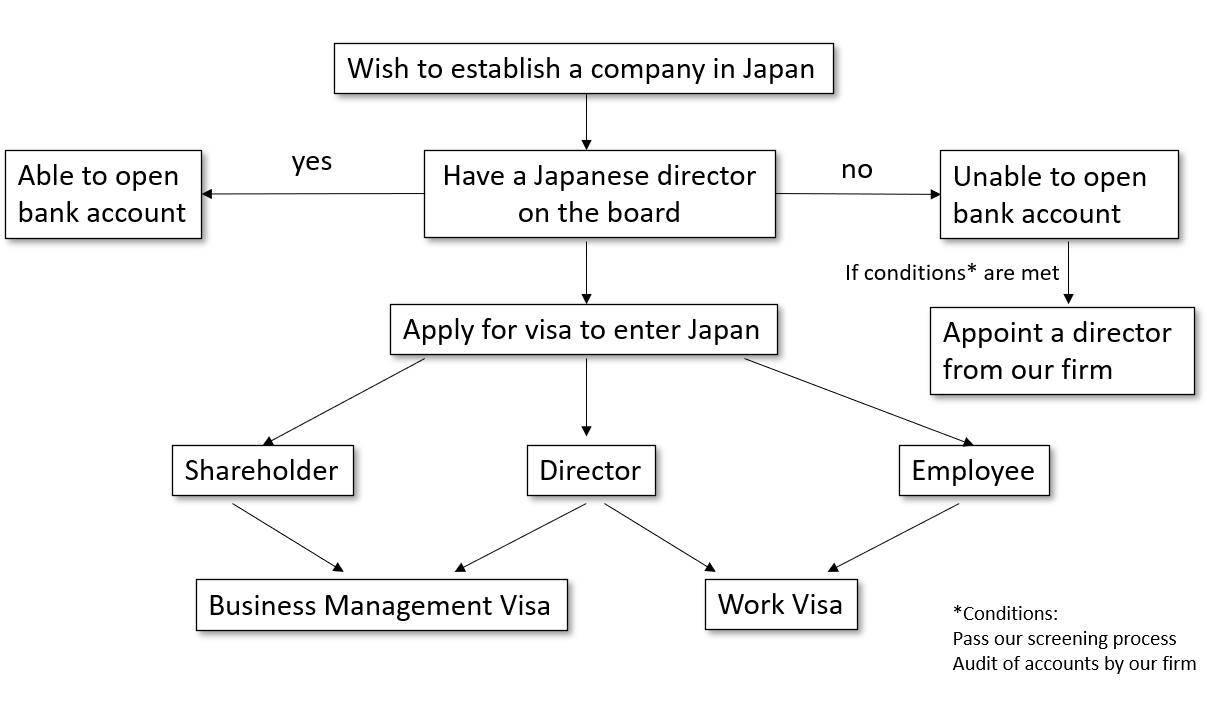

Process of Establishing a Company, Visa Acquisition

and Entry to Japan

Entry to Japan on a short-term visa

Research and preparation for incorporation

Registration of incorporation and establishment

Application for Certificate of Eligibility for Residence to the

Immigration Bureau(after company registration)

Obtain Certificate of Eligibility for Residence

Visa application with Certificate of Eligibility at Japanese

diplomatic mission abroad

Acquisition of Visa at Japanese diplomatic mission abroad

Entry into Japan, seal of landing verification, issuance of residence card

Process of Incorporation

Joint-Stock Company

Determination of profile of joint-stock company to

be established and establishment of office

Preparation of LLC’s articles of incorporation

Acquisition of registratioin certificates, etc. for

parent company, affidavit regarding profile of parent

company and affidavits regarding signatures of

representatives of parent company

Notarization of joint-stock company’s articles of

incorporation by Japanese notary

Remittance of joint-stock company capital to

account of incorporator, representative director,

or director at incorporation

Appointment of directors, representative

directors and corporate auditors

directors and corporate auditors

Examination by directors and auditors

of legality of establishment

procedures and incorporation date

of legality of establishment

procedures and incorporation date

Application at the Legal Affairs Bureau for registration of joint-stock company establishment (joint-stock company establishment date); registration of company seal at the Legal Affairs Bureau

Acquisition of certificate on registered information and company seal impression certificate

Opening a bank account under company name

Notification of incorporation to the tax office and

local government

Notification of stock acquisition to the Bank of

Japan (notification prior to company establishment

may be required in certain sectors)

LLC

Determining the profile of LLC to be established

and establishment of the office

and establishment of the office

Preparation of articles of incorporation

Acquisition of registration certificates for companies that will become equity participants, affidavits

regarding signatures of representatives of parent

company, etc.

Notarization of LLC’s articles of incorporation by

Japanese notary

Payment by members of investment

Application at the Legal Affairs Bureau for

registration of establishment of LLC (LLC

establishment date), registration of company

seal at the Legal Affairs Bureau

Acquisition of certificate of registered information

and company seal impression certificate

Opening a bank account under company name

Notification if incorporation to the tax office and

local government

Notification of stock acquisition to the Bank of

Japan ( Notification prior to company establishment

may be required in certain sectors)

Necessary Documents for Incorporation

Joint-Stock Company

- Document(s) certifying that the foreign company has

decided to establish a subsidiary company (record of

proceedings) - Foreign company's articles of incorporation, establishment

certificate, registration certificate and other official

documents - Affidavit of the profile of the foreign company

- Document(s) certifying the authenticity of the signature of

the foreign company's representative - Article of incorporation of the Japanese corporation

- Certificate of remittance of the Japanese joint-stock

company capital - Record of proceedings on appointment of directors and

other officers of the Japanese corporation - Signature and seal certificate of the Japanese corporation’s

representative director - Signature and seal certificate of the Japanese corporation’s

directors - Report of company establishment procedures, etc.

LLC

- Document(s) certifying that the foreign company has

decided to establish a subsidiary company (record of

proceedings) - Foreign company's articles of incorporation, establishment

certificate, registration certificate and other official

documents - Affidavit of the profile of the foreign company

- Appointment or acceptance letter of executive officers

(representative member in the case of a corporation) - Signature certificate of the representative of the foreign

company - Article of incorporation of the Japanese LLC

- Certificate of remittance of payment by members of

investment stipulated - Seal certificates of representative members and executives

of the Japanese LLC

Proof of Investors

When establishing a company in

Japan, the investors of the

company (or its representatives if

the investors are companies) must

submit documents to the Legal

Affairs Bureau to prove that it is a lawful and legitimate

individual or entity.

Proof of Directors

When establishing a company in

Japan, the directors of the

company (and the auditors, if any)

must submit documents to the

Legal Affairs Bureau to prove that

he/she is a lawful and legitimate individual.

General Rule

If the investor has an address in Japan, submit the seal

registration certificate. It can be acquired at the municipal

office.

Special Case

In the case the investor is a company

If the company and its representatives do not have an

address in Japan, an affidavit (statement for China) should

be prepared locally and certified by a notary public. It will

be then translated to Japanese. The affidavit must contain

name, address and date of birth.

If the investor is a corporation, prepare an affidavit from

the representative of the corporation. Some affidavits may

or may not have a template at the notary public. We can

provide an English version if required. Affidavit may

require a letterhead.

A notary public is a notary office that has jurisdiction over

its area, for example a notary office in China has

jurisdiction over territories in China and a notary office in

Hong Kong has jurisdiction only in Hong Kong.

General Rule

If the investor has an address in Japan, submit the seal

registration certificate. It can be acquired at the municipal

office.

Special Case

If the individual does not have an address in Japan

( haven’t registered their address), ask a notary public to

notarize their signature ( or seal certificate) in the country

of your nationality. It will then be translated to Japanese.

Proof of signature must include the individuals name,

address and date of birth.

Required Notifications after Registration

National tax authorities

- Notification of incorporation in case of a subsidiary corporation

File within 2 months from date of incorporation - Notification of acquisition of status of foreign ordinary corporation in case of a branch

File within 2 months from date of acquisition of status of foreign ordinary corporation - Application for approval of filing a blue form tax returns

Public employment security authorities

-

Notification of coverage of establishment by employment insurance

(including notification of acquisition of insured status) -

This must be filed within 10 days of first hiring workers

Labor standard inspections authorities

- Labor standards enforcement report

- Labor insurance: notification of establishment of labor insurance relationship and declaration of

estimated insurance contribution - Agreement on overtime and holiday work

- Rules of the employment

Pension authorities

*“Employees” here also includes representative of corporations, such as representative directors

- Notification of first-time coverage by health/employees’ pension insurance

File within 5 days of first hiring employees at a corporation or other establishment covered by

social insurance - Notification of acquisition of insured status under health/employees’ pension insurance

File within 5 days of hiring employees - Notification of addition/removal of dependents of insured employee

Files within 5 days if a person (employee) covered by health insurance had dependents - Notification of acquisition of type 3 insured status under the National Pension

File within 5 days if a spouse of an insured person (employee) is dependent

Prefectural and municipal tax authorities

- Notification of incorporation or establishment of branch

Must be filed with each of the prefectural and municipal authorities to

Short-term Stay Visa

Any foreign national wishing to enter Japan must have a valid passport, which, in principle, contain a visa corresponding

to his/her purpose of entry into Japan obtained in advance from a Japanese Embassy or Consulate.

When setting up an office, branch office or preparing to establish a corporation in Japan, first you must obtain a

temporary visitor’s visa at the Japanese Embassy/Consulate. Upon landing in Japan, the foreign national must then be

screened by, and receive a landing permission stamp from, an immigration office at the port of entry. (visa requirement

does not apply to entry by nationals of countries with which Japan has reciprocal visa exemption arrangement for

temporary visitor's visa)

Investment in Japan, market research and other preparatory activities for starting a business in Japan are generally

considered to be within the scope of short-term activities. The period of stay will be 90 days, 30 days, or 15 days.

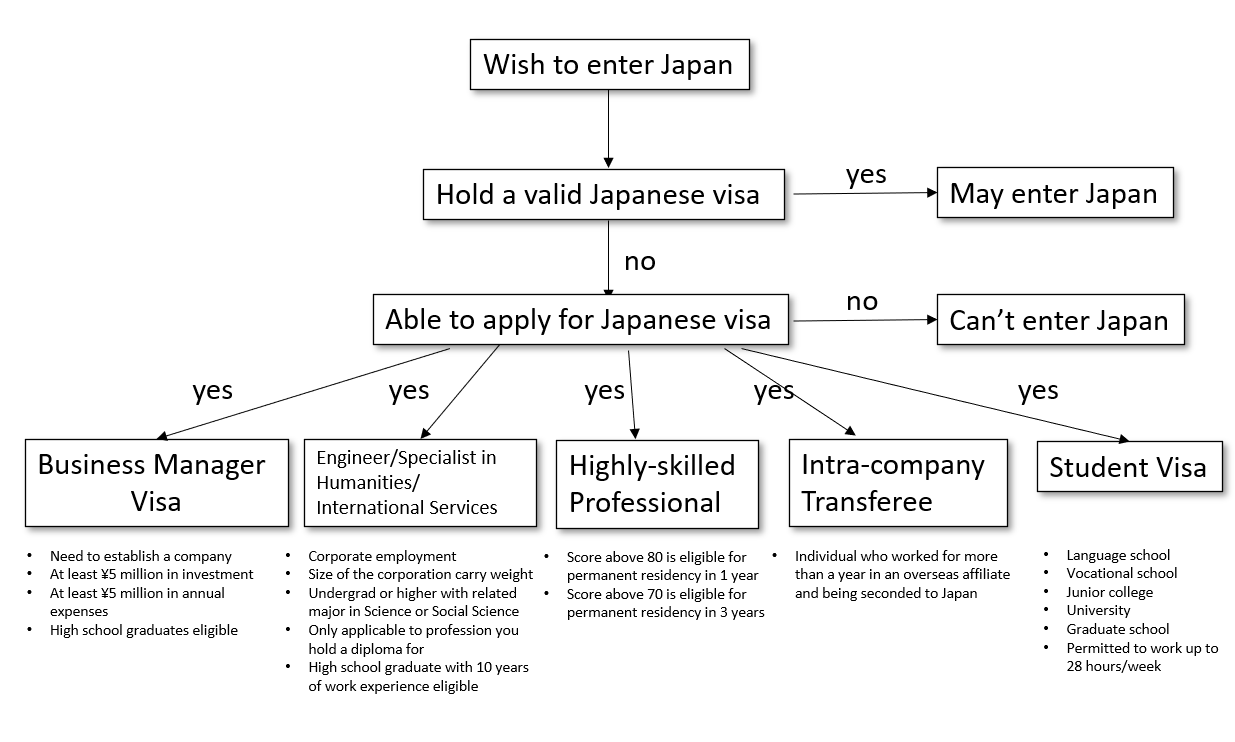

Visa Types

| Business manager | Active in operating or managing international trade or other areas of business within a public or private organization in Japan. |

|---|---|

| Engineer Specialist in Humanities Internatioal Services | Engaged in services which require skills or knowledge pertinent to physical science, engineering or other natural science fields, or in services which require knowledge pertinentto jurisprudence, economics, sociology or other human science fields, or in services whichrequire special consideration or sensitivity based on experience with foreign culture, basedon a contract with a public or private organization in Japan. |

| Highly-skilled Professional | A points-based system based on “academic background,” “professional career,” “annual salary” and the like. If the total points reach a certain number (70 points), preferentialimmigration control and residency management treatment will be granted to the relevant person, with the aim of promoting the acceptance of highly-skilled foreign professionals in Japan. |

| Intra-company Transferee | A staff member transferred to a business office in Japan for a limited period of time from a business office established in a foreign country by a public or private organization which has its head office, branch office or other business office in Japan, to conduct work at said business office in Japan in regards to Engineer/Specialist in Humanities/International Services. |

Acquisition of Visa

Necessary Documents for Visa Application

The following documentation is generally needed when applying for a working visa at a Japanese diplomatic mission

abroad after a Certificate of Eligibility has been issued:

Necessary Documents

- Visa application form

- Passport

- Certificate of Eligibility and copy thereof

- Full-face photograph (1-2 photos, 4.5 cm in height x 4.5 cm in width)

- Other documents that may be required for visa application process

FAQ about Visas

Are there any documents that need to be translated to Japanese during company establishment and visa

application?

All non-Japanese documents must all be translated to Japanese. We will provide you with the list of documents after a contract

has been signed with us, as we will know more in detail about your business.

Does a business manager visa have indefinite duration as long as there is reason for the

individual to stay and work?

Yes, but if the individual's duration of stay in Japan is too short, it may be deemed that the visa is not necessary for him/her and

the renewal may be denied. Also, it is very likely that you will not be granted a visa for more than one year.

Should an I stay in Japan for more than half a year even if I don’t have a reason to? Or, like business manager visa, as long as there is an acceptable reason to stay in Japan it is

indefinite?

Same as Q2. Business manager visa and engineer/specialist in humanities/international services visa are the

same. With a business manager visa, if your stay in Japan is short you many not be able to renew your visa.

Status of Residence

Foreign nationals entering and wish to reside in Japan must generally receive landing permission upon arrival at the airport, at

which point the residence status of the individual will be determined. The scope of activities in which a foreign individual may

engage during their stay in Japan is determined by their residence status.

Common Status of Residence in Japan

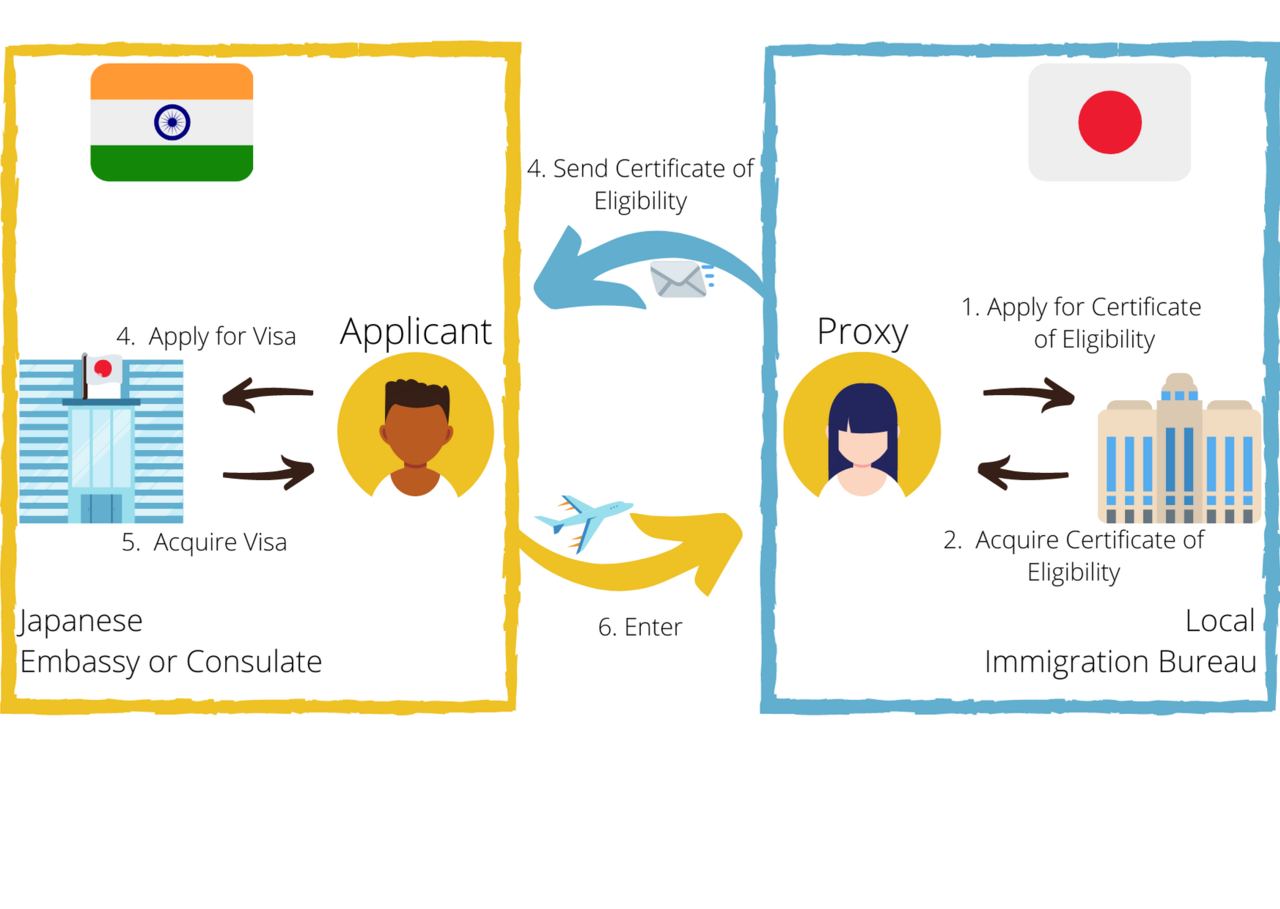

Process from acquisition of Certificate of Eligibility to acquisition of visa

<In Japan> Application for Certificate of Eligibility (submitted to Immigration Bureau in Japan) by the applicant or his/her proxy

<In Japan> Issue of Certificate of Eligibility (by Immigration Bureau in Japan); sent to applicant or his/her proxy in Japan

<Outside Japan> Visa application with Certificate of Eligibility at Japanese diplomatic mission abroad

<Outside Japan> Visa issuance at Japanese diplomatic mission abroad

<In Japan> Seal of landing verification, enter Japan

<In Japan> Residence card issued (applicable to major airports only)

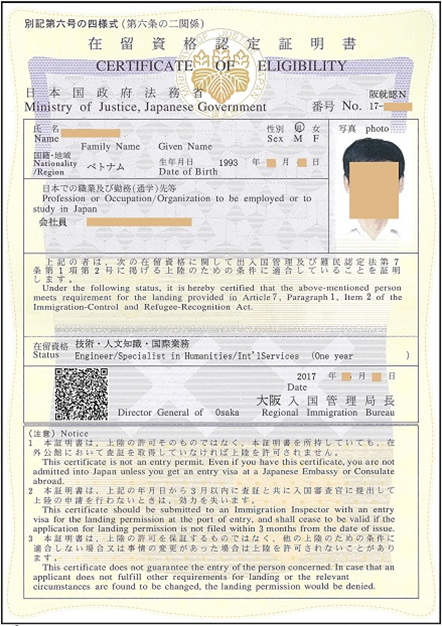

Documentation needed when applying for a Certificate of Eligibility

The Immigration Bureau in Japan often screens applications when a foreigner wishes to enter on a non “Temporary Visa” in

advance to determine whether or not the activities intended by the foreign national wishing to enter and reside in Japan

correspond to the conditions for the status of residence being sought; if it is determined that these activities do in fact meet the

conditions for the status of residence, a Certificate of Eligibility is issued.

<Required Documents> for New Establishment

- Application for Certificate of Eligibility

- One full-face photograph (4 cm in height x 3 cm in width)

- Return-mail envelope (with 392 yen postage affixed)

- A copy of employment agreement

- Certified copy of the company register of an organization of affiliation

- Company brochure, copy of financial statements of an

organization of affiliation in Japan - For new establishment; a business plan that clarifies

income and expenditure estimates

- If the organization is exempted from withholding at

source; certificate on the foreign corporation’s exemption from withholding at source or other document stating that the

organization does not require withholding at source. - If the organization is not exempted from withholding at

source; a copy of Notification on the Establishment of a Salary-Paying Office and a Statement of Collected Income Tax on

employment income and retirement income of the last three

months (a copy of the document with receipt date stamp) or if the organization is subject to special provisions regarding due dates, a document stating the approval for that is required.

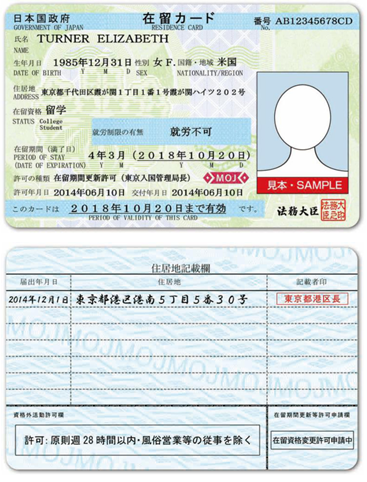

Residence Card

A residence card is a card issued to foreign nationals residing legally in Japan

for the mid to long-term who have resident status under the Immigration

Control Act (“mid to long-term residents”) when they are granted a residence-

related permit, such as landing permission, permission for change of status of

residence, and permission for extension of period of stay. Mid to long-term

residents carry a resident card while living in Japan and are included in the

Basic Resident Register like Japanese nationals.

The card includes the following information: name, nationality/region, date of

birth, gender, status of residence, period of stay, and it includes information

such as work authorization and is required to be carried at all times.

In addition, foreign nationals to whom a resident card is issued are obliged to report their place of residence at the municipal office within 14 days of finding a residence

Corporate Taxes

National and Local Government

Japan is divided into 47 prefectures, and under these prefectures, there are many more municipalities.

There are two types of taxes: those that are paid to the government and those that are paid to the prefectures and

municipalities listed above (these are called local governments).

Companies when being established may freely choose when their fiscal year starts. Most companies in Japan have a fiscal year that runs from April to March of the following year. Fiscal year from January to December of the following year is the

second most common option. For Joint-stock Company or LLC, the fiscal year is defined in the articles of incorporation.

Companies must calculate their income for each business year which is used to determine the corporate taxes to be levied on a corporate income. The amount of income used as the tax base for corporate taxes on income for each taxable year is determined by making the necessary tax adjustments to corporate profits calculated using accounting standards generally accepted as fair and appropriate.

Corporate Taxes

Consumption Tax

As described on the previous page,

the following taxes are levied on

"corporate income" which is

profit made through corporate

activities plus or minus the

necessary tax adjustments.

1.Corporate Tax(National Tax)

2.Corporate Inhabitant Tax(Local Tax)

3.Enterprise Tax(Local Tax)

4.Special Local Corporate Tax*

*National tax, although filings and payments are made to local governments

along with enterprise tax.

Corporate Tax Rate(SME)

Annual Taxable Income up to 8 million yen 15%

Annual Taxable Income over 8 million yen 23.4%

In addition, when corporate local tax, corporate enterprise tax and such

are also levied, the effective tax rates are approximately 25-35%.

The tax rates are subject to change.

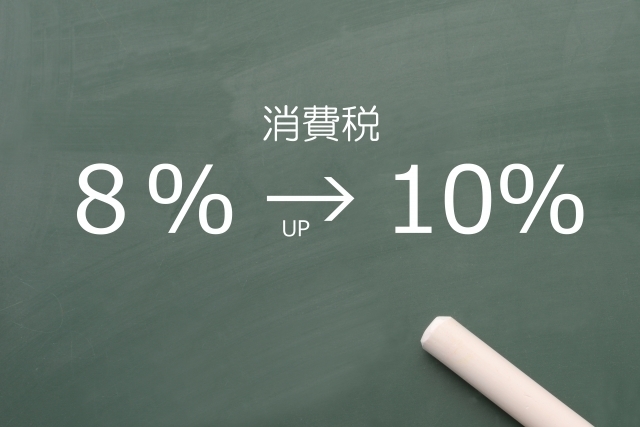

The following domestic and import transactions, except for certain

transactions deemed non-taxable, are subject to consumption tax.

Consumption tax rate has been

raised to 10% from October 1, 2019.

A reduced tax rate of 8% will be applied to transactions

such as food and beverages that are deemed essential

Domestic transactions: the transfer or rental/lease

of assets or the provision of services as a business in

Japan by an enterprise for consideration.

Import transactions: foreign cargo retrieved from a

bonded zone

Individual Tax

Individual Income Tax

Salaries, wages, bonuses, and other similar compensation paid to residents in Japan are subject to tax withholding.

In addition, other prescribed income to residents such as interest, dividends, retirement allowance, compensation, fees, etc., to certain

professionals are subject to personal income tax.

Companies who pay income subject to withholding and must pay the taxation office the amount of tax withheld no later than the 10th

day of the month following that the income was paid.

A special measure is provided for small businesses with fewer than 10 employees on the payroll, which allows them to pay withholding

income tax in six-month installments twice a year (by July 10 and January 20).

Japan Market Entry FAQ

What is the difference between a registered seal (round seal), an unregistered seal (square seal) and a registered bank seal?

Do the names of investors have to appear on the bank book of the investment deposit?

Can I open a corporate bank account if the head office is a rental office?

When should I sign the contract for head office lease?

How is the business purpose of the company is determined?

If the type of business the company wishes to engage in required a permit from the government, is the Application for the permist also possible?

What if signature certificate is unattainable from my country?

Can the investment of LLC be made through an overseas bank account?

Can I get a copy of the real estate register?

Can a virtual office be used to set up a head office?

Can a corporate bank account be opened if the registerted head office is a virtual office?

Can I use my home address to register my company?

If there is more than one representative director, do they all need to be registered for their seals?

If I am a Japanese residing abroad, what do I need instead of a seal certificate?

Can more than one company be incorporated using the same address?

Is it possible to use online banking for the intial investment of the incorporation process?

Do I need approval from the Japanese government to establish a company from overseas?

Do Shareholders Have to Be Directors?

Is investment limited to cash?

Is it cheaper to set up a Joint-stock Company and a General Incorporated Association at the same time?

Does the signature certificate have a term of validity?

Why are companies like Apple and Amazon incorporated as an LLC?

Is it possible to set up a Joint-stock Company with a director who does not have a permanent address in Japan?

Why is it better to have a large amount of capital?

Can the capital be used before the company is established?

Which is the easiest form of corporation to remit profits to an overseas parent company?

Does the investors have unlimited liability in the event of a bankruptcy?

How much does it cost to increase capital after the establishment of the company?

How much does it cost to relocate the head office after the company is established?

Please fill out the required fields in the form below and click the submit button

Inquiries by email are available 24 hours a day.

Please note that it may take some time for us to reply to your inquiry.

If you do not receive a reply within 3 business days, please contact us again.

大見出し

ガルベラ・パートナーズは、税理士、社会保険労務士、司法書士、行政書士が1つの事務所に所属し、中小企業のサポートを得意とするワンストップ型コンサルティングファームです。

東京事務所

東京都港区虎ノ門3丁目23番6号

秀和虎ノ門三丁目ビル7階

日比谷線「神谷町駅」徒歩2分

大阪事務所

大阪市西区立売堀1丁目2番12号

本町平成ビル3階

四つ橋線「本町駅」徒歩2分

福岡事務所

博多区博多駅東1丁目5番8号

モアグランド博多ビル4階